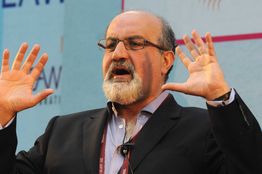

Universa Hedge Fund, a famous ‘Black Swan’ fund, made more than $1 billion in profits in one week amid volatility.The recent market rout caught some star Wall Street traders by surprise. But not a hedge-fund firm affiliated with “The Black Swan” author Nassim Nicholas Taleb, which gained more than $1 billion on a strategy that seeks to profit from extreme events in financial markets.

Universa Investments LP was up roughly 20% on Monday, according to a person familiar with the matter, a day when the Dow Jones Industrial Average collapsed more than 1,000 points in its largest intraday point decline. The blue-chip index finished down 588 points on the day.

The fund’s returns for the year climbed to roughly 20% through earlier this week, this person said. Universa holds positions designed to protect about $6 billion in client assets, according to people familiar with the firm.

“This is just the beginning,” said Universa founder Mark Spitznagel, referring to the market volatility this week. His longtime collaborator, Mr. Taleb, who advises Universa, is a professor at New York University and is known for his pessimistic forecasts on the global economy.

Tag Archives: Universa

The rocky road to big gains that might not happen – FT.com

Famed investment sage Warren Buffett, like many before him, decided to sell options. Veteran trader and renowned intellectual Nassim Taleb, on the other hand, decided to buy options. While Mr Buffett would have gone for the first choice in the game proposed at the beginning, Mr Taleb would have gone for the second choice.

So, are you a Warren or a Nassim?

In 1999, Mr Taleb founded Empirica hedge fund with his student Mark Spitznagel, with the mandate to bet on the improbable long odds market happenstance. Empirica made 57 per cent in 2000, then lost 8 per cent in 2001 and 13 per cent in 2002. It closed in 2005 and in 2007, Mr Spitznagel founded Universa hedge fund, with Mr Taleb as adviser. Universa returned 115 per cent in 2008 and 23 per cent in 2011 through August. It lost 4 per cent in 2009 and in 2010. Today, it is considered a leader in tail hedging strategies and its success together with the vindication of Mr Taleb’s philosophy by real world developments has spawned numerous imitators.

via The rocky road to big gains that might not happen – FT.com.

HatTip to Dave Lull.

Falkenblog: Is Spitznagel an Apostate?

Taleb is listed rather prominently on the Universa Website and Spitznagel graciously credits Taleb in the paper, but Taleb and/or Spitznagel have put a fork in the archetypal Black Swan theory (and yet, Taleb has never been really consistent, so one can say he meant this all along at some level). I have no doubt some people can predict infrequent events, and perhaps Spitznagel is one of them. Yet it’s pretty hard to validate objectively, and in my experienced is best done via observing all the little good investments someone has made for 10 years, something that is impossible to do in scale. The idea that if you can predict infrequent events you can do very well for yourself is true enough, but that’s a lot less useful to know than if rare events are unappreciated in general, which turns out not be be true.

via Falkenblog: Is Spitznagel an Apostate?. HatTip to Dave Lull

Taleb CNBC – If the butcher is a failed auction, watch out!

[youtube=http://www.youtube.com/watch?v=y9XrP_QWS-M]

NNT on CNBC May 12, 2010

Nassim Taleb Bloomberg 05/13/10

HatTip to EG!

[youtube=http://www.youtube.com/watch?v=OVxcDgfTzuk]

NNT was also on CNBC yesterday. The interviewers get in the way somewhat but it’s worth watching.